by Michelle Armstrong, TYS Global VP of Value Engineering

Building a dedicated telecom industry vertical around supplier management can unlock numerous advantages, enhancing data quality, streamlining workflows, and managing risks effectively. Here’s how a unified approach can transform the telecom sector:

Increased Efficiency for Suppliers

Suppliers often grapple with diverse requirements and processes for each telecom company they serve. A telecom industry vertical standardizes these processes, reducing administrative burdens and enabling suppliers to focus on delivering high-quality products and services.

Centralized Supplier Data

Creating a centralized repository for supplier information and performance data improves data accuracy and accessibility. This centralization provides telecom companies with a comprehensive view of their suppliers, enhancing decision-making and operational efficiency.

Enhanced Collaboration and Transparency

A unified platform fosters better communication and collaboration between telecom companies and their suppliers. This transparency builds stronger, more reliable relationships, facilitating smoother operations and more effective problem-solving.

Streamlined Compliance and Risk Management

Standardized supplier management processes ensure consistent compliance with industry regulations and standards. Telecom companies can more easily monitor and manage multidimensional risks, leveraging shared insights and best practices to enhance overall supply chain resilience.

Cost Savings and Innovation

Reducing redundancies and streamlining workflows can lead to significant cost savings for telecom companies and their suppliers. Additionally, a collaborative industry vertical encourages innovation, enabling suppliers to share and implement new ideas and technologies more effectively.

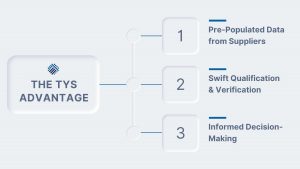

At Trust Your Supplier (TYS), we understand the critical importance of a robust telecom industry vertical around supplier management. Our blockchain-based platform ensures seamless data exchange, real-time risk monitoring, and workflow automation. By leveraging TYS, telecom companies can standardize supplier management processes, enhance data accuracy, and foster stronger supplier relationships. Let’s look at how TYS can help you build a robust telecom industry vertical, driving efficiency, innovation, and growth:

Blockchain for Secure and Transparent Supplier Management

Blockchain technology is central to our platform at TYS, providing an immutable ledger for all supplier transactions and data exchanges. This ensures data integrity, security, and transparency across the entire supply chain. Blockchain enables real-time updates and verifiable records, which are crucial for maintaining trust and accountability among telecom companies and their suppliers.

Extensive Network of Global Qualified Suppliers

Our network includes over 400 million global qualified suppliers, which supports efficient sourcing and initial risk qualification. By leveraging this extensive network, telecom companies can quickly identify and engage with suppliers that meet their specific needs and standards, significantly reducing the time and effort required for sourcing.

Preventing Supplier Fatigue

A telecom industry vertical can prevent supplier fatigue by addressing shared assessment and firmographic requirements. Instead of completing multiple assessments for different telecom companies, suppliers can provide their information once and share it across the entire vertical. This not only reduces the burden on suppliers but also ensures that telecom companies receive consistent and up-to-date information.

Building Vertical Compliance Assessments

We build vertical-specific questionnaires that, when updated by suppliers, are shared across their customer verticals. This approach ensures that all telecom companies have access to the latest supplier data, reducing redundancy and improving the efficiency of supplier assessments. By maintaining a shared pool of updated supplier information, telecom companies can streamline their evaluation processes and make more informed decisions.

Managing Multi-Dimensional Risk

A telecom industry vertical allows for more effective management of multi-dimensional risks. By utilizing a unified platform, telecom companies can monitor financial, operational, and compliance risks in real time, ensuring a proactive approach to risk management.

Working in Partnership to Address Supply Chain Requirements

Collaboration within a telecom industry vertical promotes a partnership approach to addressing supply chain requirements. Telecom companies and their suppliers can work together to develop solutions tailored to industry-specific challenges, ensuring a more resilient and adaptive supply chain.

Firmographics and Compliance Regulation

A centralized system improves the ability to track firmographic data and ensure compliance with regulations. Telecom companies can maintain up-to-date information on suppliers, ensuring adherence to regulatory standards and minimizing risks associated with non-compliance.

Environmental, Social, and Governance (ESG) Initiatives

A unified platform supports ESG initiatives by providing transparency into supplier practices. Telecom companies can monitor and promote sustainable practices, ensuring that their supply chains align with broader environmental and social goals.

Building a telecom industry vertical around supplier management offers a myriad of benefits, from enhanced efficiency and innovation to improved risk management and compliance. By partnering with Trust Your Supplier, telecom companies can leverage advanced technologies to create a resilient, efficient, and forward-thinking industry vertical.

Jim Mason’s observation resonates deeply with our ethos: “There was a clear business value opportunity in the market. The TYS team and their clients came together collaboratively to define the right solution that delivers value.” This collaborative spirit ensures that the solutions we develop are not only technologically advanced but also practically applicable and tailored to deliver tangible business outcomes.

Jim Mason’s observation resonates deeply with our ethos: “There was a clear business value opportunity in the market. The TYS team and their clients came together collaboratively to define the right solution that delivers value.” This collaborative spirit ensures that the solutions we develop are not only technologically advanced but also practically applicable and tailored to deliver tangible business outcomes.

Digital agility refers to the ability of an organization to rapidly adapt to changes, implement new technologies, and respond to market demands with speed and efficiency. For telecommunications companies, this means being able to quickly roll out new services, upgrade infrastructure, and deliver exceptional customer experiences. Achieving this level of agility requires a robust and flexible supply chain that can keep pace with the industry’s dynamics.

Digital agility refers to the ability of an organization to rapidly adapt to changes, implement new technologies, and respond to market demands with speed and efficiency. For telecommunications companies, this means being able to quickly roll out new services, upgrade infrastructure, and deliver exceptional customer experiences. Achieving this level of agility requires a robust and flexible supply chain that can keep pace with the industry’s dynamics.

Jamie emphasizes that problem-solving and adaptability are crucial skills for a blockchain engineer. Given the technology’s youth, there is a continuous influx of new information and developments. “Being able to critically evaluate situations and devise effective solutions is key,” he says. The ability to adapt and integrate new knowledge reliably ensures that professionals like Jamie stay at the forefront of this rapidly changing field.

Jamie emphasizes that problem-solving and adaptability are crucial skills for a blockchain engineer. Given the technology’s youth, there is a continuous influx of new information and developments. “Being able to critically evaluate situations and devise effective solutions is key,” he says. The ability to adapt and integrate new knowledge reliably ensures that professionals like Jamie stay at the forefront of this rapidly changing field.