Today, on Veterans Day, we take a moment to honor those who have served and sacrificed for our nation. At Trust Your Supplier (TYS), we are proud to shine a light on one of our own — John Santos, an Account Executive. With a decade of service in the U.S. Navy as a Hospital Corpsman, John brings a wealth of experience, resilience, and a unique perspective to our team.

From Combat to Compassion: A Decade in the Navy

John’s journey in the Navy was marked by diverse and challenging experiences. He served in the dual role of a Hospital Corpsman, providing medical care in high-stakes combat zones, and later as a Physical Therapy Assistant (PTA) at a military hospital. His service took him across the globe, from the heat of Afghanistan, where he supported a Marine unit on the front lines, to the early days of the pandemic, stationed in Djibouti, Africa.

As a Corpsman, John’s responsibilities extended beyond traditional healthcare. In combat, he administered emergency medicine and life-saving care under pressure. Back in the United States, his role shifted to helping severely injured service members rehabilitate. He found immense satisfaction in supporting their recovery, aiding them in regaining strength and improving their quality of life despite life-altering injuries.

Answering the Call: The Motivation Behind Military Service

For John, the decision to join the military was rooted in both practicality and a deep sense of gratitude. Initially, he sought to pay for his education, but more than that, he wanted to give back to a country that had given him so much. “The Navy was an opportunity to become a better version of myself,” he reflects. “I wanted to serve in a way that meant something.”

Lessons in Leadership: A Legacy of Mentorship

Lessons in Leadership: A Legacy of Mentorship

Throughout his time in the military and beyond, John had the privilege of working alongside what he describes as “giants” — doctors, fellow corpsmen, and leaders who exemplified excellence and empathy. Two individuals, in particular, left a lasting impression on him: Marion Jaroszynski, a Physical Therapist he collaborated with at a civilian hospital, who guided him not only in his professional duties but also in navigating life’s challenges; and Chief Belinda Daniels, who modeled quiet yet fierce leadership within the Navy. “I learned that being a strong leader doesn’t always mean being the loudest in the room,” John reflects. “Empathy can be just as powerful.”

These mentors shaped John’s approach to leadership and teamwork, lessons he continues to carry into his role at TYS today.

Bringing Military Discipline to Business Development

Transitioning from military life to the corporate world, John has applied the discipline and resilience he developed in the Navy to his work at TYS. As Account Executive, his role involves a significant amount of outreach and communication. “In the military, I learned to approach challenges with grit,” John explains. ““My perspective is different, making 100 cold calls and/or getting hanged up on isn’t so bad.”

But beyond sheer tenacity, John emphasizes the importance of empathy. “You have to listen to people and understand their needs before presenting a solution,” he says. “In combat, you’re constantly adapting to the situation in front of you. It’s the same in business — you can’t just push your agenda; you have to align with what your prospects truly need.”

Reflections on Veterans Day: A Time for Gratitude

Reflections on Veterans Day: A Time for Gratitude

When asked about what Veterans Day means to him, John is reflective. “It’s hard to accept the recognition,” he admits. “I’m proud to be a veteran, but I’ve served with people who have given so much more than I did. Some didn’t come back, or came back with fewer limbs. I’m just grateful to be here.”

John’s way of honoring the day is simple yet profound. He likes to celebrate by enjoying a good steak and appreciating the freedom he fought to protect. “It’s about enjoying the small things, the freedom we sometimes take for granted. That’s what makes me proud to be an American.”

A Salute to Service

On this Veterans Day, we at Trust Your Supplier extend our deepest gratitude to John Santos and all veterans who have dedicated their lives to serving our country. Their courage, discipline, and leadership inspire us every day.

Thank you, John, for your service and for bringing those invaluable lessons to our team. Today, we honor you and the countless others who have sacrificed so much to safeguard our freedom.

Happy Veterans Day!

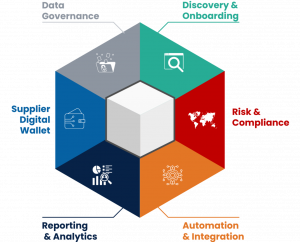

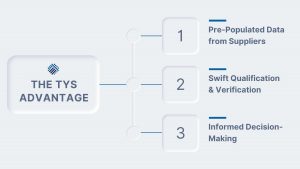

Jim Mason’s observation resonates deeply with our ethos: “There was a clear business value opportunity in the market. The TYS team and their clients came together collaboratively to define the right solution that delivers value.” This collaborative spirit ensures that the solutions we develop are not only technologically advanced but also practically applicable and tailored to deliver tangible business outcomes.

Jim Mason’s observation resonates deeply with our ethos: “There was a clear business value opportunity in the market. The TYS team and their clients came together collaboratively to define the right solution that delivers value.” This collaborative spirit ensures that the solutions we develop are not only technologically advanced but also practically applicable and tailored to deliver tangible business outcomes.

Digital agility refers to the ability of an organization to rapidly adapt to changes, implement new technologies, and respond to market demands with speed and efficiency. For telecommunications companies, this means being able to quickly roll out new services, upgrade infrastructure, and deliver exceptional customer experiences. Achieving this level of agility requires a robust and flexible supply chain that can keep pace with the industry’s dynamics.

Digital agility refers to the ability of an organization to rapidly adapt to changes, implement new technologies, and respond to market demands with speed and efficiency. For telecommunications companies, this means being able to quickly roll out new services, upgrade infrastructure, and deliver exceptional customer experiences. Achieving this level of agility requires a robust and flexible supply chain that can keep pace with the industry’s dynamics.