Energy and Utility (E&U) organizations operate within one of today’s most complex and operationally challenging supply chain environments. They are interdependent industries where reliability and resilience are non-negotiable. As these industries evolve, they face three key operational challenges, ranging from ensuring a consistent supply of the goods and services (at stable prices) required to maintain an aging utility grid, balancing energy transition with compliance requirements, and mitigating a wide range of supplier risks – especially cyber vulnerabilities.

According to Hemingway’s Law of Motion, these challenges can lead to an unforeseen collapse which “happens gradually and then suddenly” where seemingly manageable issues can escalate into critical failures if not addressed proactively. What’s needed is a novel approach to supplier and risk management, one that anticipates and mitigates risks before they impact operations.

In order to deliver meaningful change, leaders across the sector need to be intellectually honest about their current state and capabilities and curious about what practical steps they can take to improve how they operate. In this case, the improvement that I’m referring to is a future state that provides the visibility, and end-to-end capabilities required to mitigate key challenges before they reach a tipping point.

Aging Infrastructure: A Pressing Concern

One of the most consequential challenges facing the energy and utility sectors is aging utility infrastructure. According to a U.S. Grid Deployment Office (GDO) report, over 70% of the U.S. utility grid is more than 25 years old and will require substantial modernization or complete replacement. This ongoing issue not only impacts reliability but also significantly increases maintenance costs. The American Society of Civil Engineers (ASCE) Infrastructure Report Card underscores that aging infrastructure requires more frequent repairs and faces an increase in prolonged outages that can erode customer trust and impact daily life.

Moreover, the Department of Energy (DOE) highlights that outdated infrastructure cannot support the advanced technology needed for grid modernization and integration of renewable energy sources. This presents a considerable obstacle as utility companies strive to meet regulatory requirements and sustainability goals. As infrastructure projects ramp up, the demand for raw materials and components increases, leading to potential supply bottlenecks, which can further delay critical upgrades and increase costs.

How TYS Helps:

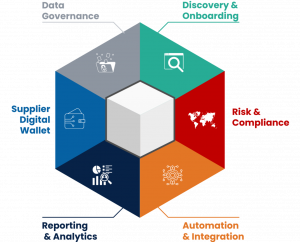

Maintaining aging infrastructure requires a diversified supplier base to provide specialized components and services, which can be challenging to source, especially in a landscape prone to supply bottlenecks. TYS simplifies the diversification process by providing U&E companies with the tools to segment and identify potential risks and the ability to quickly discover, assess, and onboard suppliers.

TYS provides comprehensive visibility into your entire supplier base, as well as the agility and controls required to mitigate risks proactively, ensure compliance, and enhance operational efficiency. By leveraging clean and continuously maintained data in addition to a network of trusted suppliers, companies can pre-qualify and onboard new suppliers with speed and precision. Furthermore, TYS’s automated monitoring capabilities ensure continuous oversight of supplier risk and compliance with regulatory standards, allowing organizations to address potential issues before they reach a tipping point.

This holistic approach streamlines procurement processes, fortifies supply chain resilience, and empowers utilities to maintain and modernize their aging infrastructure without unexpected delays or disruptions due to supplier challenges.

Energy Transition & Compliance Management: Balancing Innovation and Regulation

The global push towards clean energy has added a new layer of complexity to the energy and utility industries. Transitioning to renewable energy sources like solar, wind, and hydroelectric power necessitates significant infrastructure upgrades, while the rapidly evolving regulatory landscape requires meticulous compliance management.

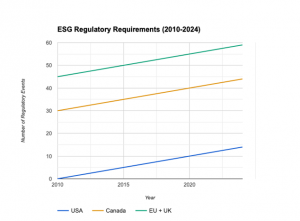

As regulations become more stringent, utility companies face increasing pressure to meet Environmental, Social, and Governance (ESG) standards. This challenge extends to the careful selection of suppliers who align with these criteria. KPMG emphasizes that non-compliance with safety and environmental regulations can lead to severe penalties, operational setbacks, and reputational damage.

How TYS Helps

TYS simplifies compliance management by enabling utility companies to quickly find and onboard suppliers that meet sustainability and regulatory requirements. The platform offers an intuitive supplier discovery experience through features like dynamic search and filtering, making it simple to identify suppliers within a trusted network that adhere to compliance criteria.

The procurement process is also streamlined by enabling efficient review and consensus approvals on internal supplier requests before initiating contact. TYS’s flexible platform supports customization of the prequalification process with tailored assessment questionnaires, automated approvals, and segmented validations to ensure alignment with specific business requirements.

Compliance initiatives are seamlessly managed through a combination of up-to-date supplier compliance questionnaires and risk data from trusted partners. This approach provides both qualitative and quantitative insights, supporting informed decision-making.

Once suppliers are onboarded, TYS’s life cycle monitoring tools offer ongoing visibility into compliance, reducing the risk of penalties and helping to maintain a strong reputation.

Risk Management: Safeguarding Against Disruptions

The E&U sectors are facing an increasing frequency of disruption driven by global events such as pandemics, geopolitical conflicts, natural disasters, and trade restrictions. Additionally, the exponential rate of integration of digital technologies is driving a significant volume of new cybersecurity attacks. In fact, Power Grid International reports a 71% rise in cyberattacks on utility companies in North America in just the last year.

Effective risk management is often hampered by fragmented data management processes, which can lead to limited visibility across the supplier network. This lack of transparency is a direct result of outdated information creating sub-optimal conditions for decision-making, leaving companies ill-prepared to respond to emerging threats.

As digital technologies are being continually implemented across utility operations, the stakes of cybersecurity continue to grow. Cyberattacks can compromise sensitive data, disrupt essential services, and inflict severe financial and reputational damage.

How TYS Helps:

TYS offers a secure and comprehensive risk management solution that enhances visibility across the supply chain. This enables companies to identify potential risks related to cyber security and respond proactively. By integrating data from leading risk intelligence providers, E&U organizations can continuously access reliable, “best-of-breed data” that supports informed decision-making.

Additionally, TYS provides supplier profiles that can be enriched with critical information from top cyber risk intelligence sources, allowing companies to assess and monitor cyber threats associated with their suppliers. This comprehensive understanding of potential risks is further strengthened by TYS’s use of blockchain technology, which minimizes the risk of data breaches and provides a secure environment for supplier interactions, protecting against operational and reputational damage.

The TYS platform includes comprehensive risk monitoring workflows that continuously track changes in supplier risk profiles. These workflows trigger an automated approval process that will re-evaluate key data points and provide a best-in-class risk management process.

Through these capabilities, TYS empowers utility companies to build resilient and reliable supply chains that can withstand global challenges and safeguard their operations against emerging risks.

TYS: Empowering Energy and Utility Companies for Long-Term Success

In an industry defined by aging infrastructure, the transition to renewable energy, and the growing risks of global supply chain disruptions, energy and utility companies face challenges that demand innovative solutions.

Trust Your Supplier (TYS) provides a comprehensive suite of tools that allow organizations to rethink their risk management posture and redesign their supplier management process, enhancing visibility, digitizing processes, and strengthening risk and compliance management.

From supplier discovery and onboarding to multi-dimensional risk management, TYS equips companies with the capabilities needed to build resilient, reliable, and compliant supply chains and position themselves for sustainable success in an ever-evolving industry.

Want to dive deeper into these insights? Watch our vlog where Nick Piccone explores these complexities how Trust Your Supplier can help you overcome them. Check it out here.