Supplier Management Scalability: Practical Steps for Growing Organizations

Is Your Supplier Management Platform Ready to Scale?

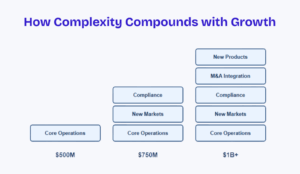

Organizational growth is rarely linear. Drivers of growth may include organic demand, entry into a new market, the launch of a new product line, or a merger or acquisition. While each of these represent strategic wins for the business, they place immediate operational strain on supplier management. As a result, procurement teams must quickly coordinate an expanding supplier network while staying compliant and efficient.

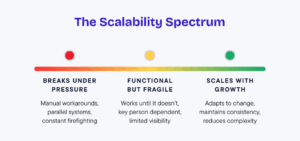

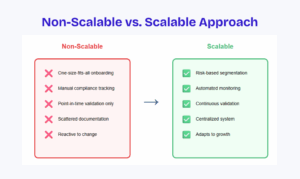

What works for a $500M organization with a stable supplier base often breaks at $1B. This is especially true when growth crosses borders or follows an acquisition. Importantly, it's not caused by lack of effort by the procurement organization. Instead, it usually points to supplier management processes and systems that were not designed to sustain growth.

Scalability in procurement isn’t just about handling more suppliers. Rather, it’s about managing more complexity without slowing the business or increasing risk. In practical terms, scalable procurement allows teams to:

- add suppliers without adding a high amount of manual work

- adjust compliance requirements by market or risk level

- integrate new teams and data efficiently

- maintain visibility as complexity increases

In short, scalability enables growth without forcing procurement to redesign processes or lower standards.

Below are three common growth scenarios that expose Supplier Relationship Management scalability gaps, along with practical steps procurement teams can take to address them.

Scenario 1: Entering a New Market Brings New Compliance Requirements

Market expansion is a quick way to expose weaknesses in supplier onboarding and validation. New geographies bring different regulations, document requirements, and local validation standards. At the same time, regulatory, partner and customer scrutiny increases. Unfortunately, many organizations only realize this once expansion is already underway.

As a result, familiar challenges emerge. Teams try to reuse the same onboarding checklist globally, manage. They will manage local compliance through spreadsheets or email or rely heavily on regional teams to interpret requirements. In some cases, unclear supplier requirements delay market entry or introduce avoidable compliance risk.

Practical Steps to Address Market Expansion

- Separate global from local requirements. Define which compliance elements apply to all suppliers, and which vary by market or regulation.

- Configure onboarding workflows by geography. Show suppliers see only the requirements that apply to them, reducing friction while maintaining rigor.

- Standardize evidence collection and validation. Use consistent rules for documentation and approvals to maintain visibility and auditability.

- Design for regulatory change. Build flexibility into workflows so evolving regulations don’t require process redesign.

With a scalable approach procurement can support market expansion proactively, instead of reacting to compliance issues after the fact.

Scenario 2: New Lines of Business Require New Types of Suppliers

Launching a new product or service often means new suppliers, or types of suppliers that your procurement team hasn’t managed before. These may include suppliers of now needed components, new technology providers, service-based partners, or intermediaries. Notably, these supplier types can carry different risk profiles than traditional suppliers. As a result, applying a uniform approach quickly becomes inefficient and risky.

In practice, procurement teams often struggle when they rely on one-size-fits-all questionnaires. Some suppliers are over-validating suppliers, while others are under-validated. Meanwhile, manual workarounds emerge to keep the business moving. In fast-growth situations, pressure may also mount to cut corners in the name of speed.

Practical Steps to Address Supplier Diversity

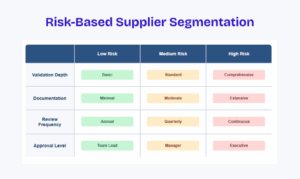

- Segment suppliers early. Categorize suppliers based on risk, role, and business impact to guide downstream requirements.

- Apply risk-based onboarding. Align the depth of validation with the supplier’s risk profile, reducing unnecessary effort for low-risk suppliers.

- Tailor compliance requirements by supplier type. Use baseline questionnaires supplemented by targeted questionnaires for specific supplier requirements.

- Enable modular expansion. Ensure new supplier types can be added without reworking existing processes.

Scalable supplier management allows procurement to support innovation and growth without compromising consistency or control.

Scenario 3: M&A Brings Supplier Portfolios That Must Be Assimilated

Mergers and acquisitions introduce immediate complexity into supplier management. Acquired organizations bring their own suppliers, often with overlapping relationships, inconsistent data quality, and differing validation standards. Because compliance gaps are not always visible at the start, integration becomes both urgent and risky.

Without a scalable approach, supplier integration is often delayed or treated as a clean-up exercise. This causes parallel systems persist, duplicate suppliers go unnoticed, and procurement lacks a consolidated view of supplier risk.

Practical Steps to Address Supplier Assimilation

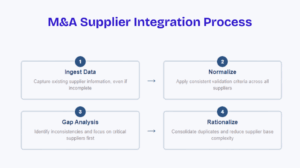

- Ingest supplier data quickly. Capture existing supplier information early, even if it is incomplete.

- Normalize suppliers against a common standard. Apply consistent validation criteria to identify gaps and inconsistencies.

- Conduct targeted gap analysis. Focus on remediation for critical and higher-risk suppliers first.

- Rationalize the supplier base. Identify duplicate suppliers and consolidation opportunities to reduce exposure and complexity.

When supported by the right structure, scalable supplier management transforms M&A from a risk-heavy transition into a clearer path to value realization.

Additional Scalability Pressures Procurement Often Underestimates

Growth also introduces less visible challenges. As organizations expand, decision-making becomes more distributed and accountability less clear. This increases the risk of inconsistency. Meanwhile, supplier risk evolves over time, making point-in-time validation insufficient.

Scalable supplier management supports configurable governance, continuous monitoring, and centralized visibility allowing procurement to operate without fragmentation.

What to Look for in a Scalable Supplier Management Solution

When evaluating supplier management systems, procurement leaders should look beyond today’s requirements. Instead, they should assess whether a platform can adapt over time. Key considerations include:

- configurable workflows,

- support for supplier segmentation and risk-based onboarding

- the ability to introduce new compliance frameworks

- structured supplier data

- collaborative tools to allow participation from different functions within the organization

- continual monitoring of supplier base to reduce risk and reliance on point and time validation

Scalability is less about feature count and more about long term adaptability.

Final Thought: Growth Should Test Strategy, Not Infrastructure

Growth exposes weaknesses because systems weren’t designed for what comes next. Organizations that invest in scalable supplier management are better positioned to enter new markets, support innovation, manage risk through change, and avoid repeated system replacements.

The most resilient procurement teams don’t react to growth. They’re ready for it.

This is Part 2 of our Supplier Management at Scale series:

Part 1: When Supplier Risk Outgrows a Small Team

Part 2: Supplier Management Scalability: Practical Steps for Growing Organizations

Part 3: How to Choose the Right Supplier Management Platform

Part 4: Common Supplier Onboarding Mistakes That Compound Over Time

Next: Read Part 3 → or Select from the full series below.