Search our Posts

From Reactive to Resilient: Modern Supplier Management Built for Real-World Failures

When Your Airline App Is Smarter Than Your Supplier Management System

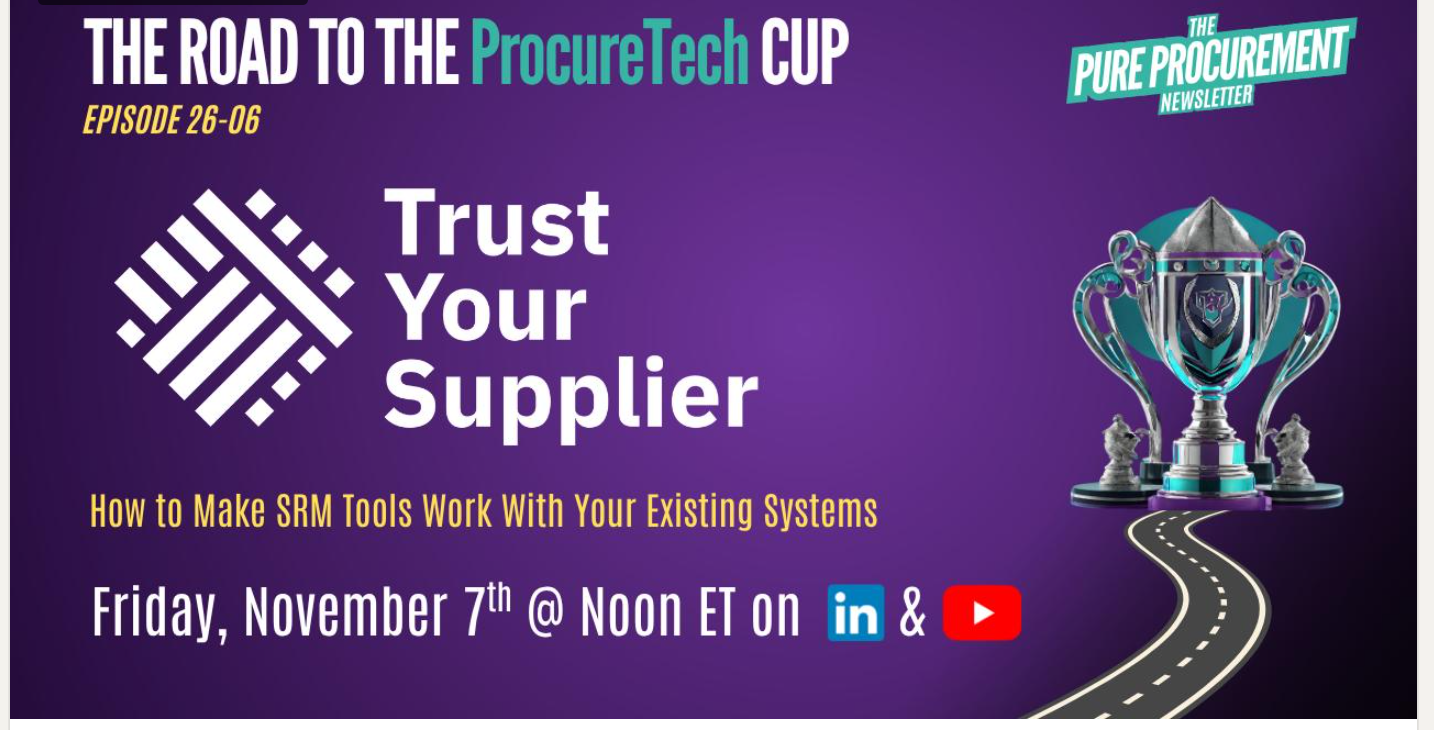

Bridging Platforms for Smarter Procurement: TYS Presents on LinkedIn Live “The Road to the ProcureTech Cup”

From Friction to Flow: Lessons in Better Supplier Data Management

The True Cost of Cyberattacks on Municipalities

Introducing TYS Essentials: Scalable Supplier Management Without the Complexity

Trust Your Supplier Wins the 2025 Pure Procurement ProcureTech Cup!