Fraud Prevention

Stop Fraud Before It Hits Your Business

79% of organizations were targeted by payment-fraud attacks or attempts in 2024.

Payment fraud isn’t just a finance problem. It’s a business risk.

TYS Essentials verifies supplier information to stop fraud before payments go out.

Manual Processes Put You at Risk

Callbacks, outdated bank data, and email approvals leave the door open to fraud and audit risk.

KEY RISKS YOU FACE TODAY

1. Fake Supplier Details Slip Through

Banking data changes aren’t always verified.

2. Impersonation Attacks Are Rising

Fraudsters mimic suppliers to reroute payments.

3. Manual Bank Verifications Are Too Slow

Callbacks and forms don’t scale or protect you.

4. Compliance Gaps Grow

Missing or invalid tax forms create audit risk.

5. No Global View of Risk

Fragmented validation tools limit fraud visibility.

How TYS Essentials Prevents Fraud

Bank Account Validation

Verify supplier banking details before releasing payment to avoid fraud and misdirected funds.

Tax Document Compliance

Collect and validate tax forms automatically to meet financial and regulatory requirements.

Global Verification Coverage

Support suppliers in multiple jurisdictions with regionally compliant validation tools.

Real-Time Alerts

Get notified when supplier information changes, helping you respond before fraud occurs.

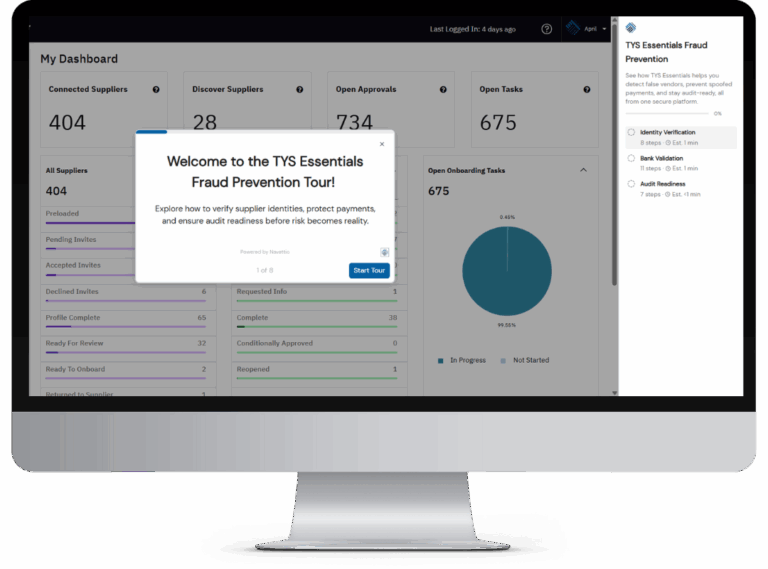

Explore Every Layer of Fraud Prevention

See how TYS Essentials helps your team stop fraud before it happens.

In this interactive tour, you’ll explore each protective layer step by step:

-

Validate vendor data and identities

-

Validate bank details and account changes

-

Validate compliance and audit readiness

KEY BENEFITS

What you gain with TYS Essentials

Stop Fraud Before It Starts

Bank and tax checks happen early and automatically.

Faster, Safer Onboarding

Fewer manual reviews and no skipped steps.

Rapid Deployment, Predictable Costs

Go live in weeks, starting at $25K/year.

Audit-Ready Compliance

Track all verifications and document history for regulators and auditors.

Global Coverage, Local Compliance

Support suppliers in multiple jurisdictions with regionally compliant validation.

WHITEPAPER

Stop Supplier Fraud Before It Starts

Our free whitepaper shows how modern teams are protecting supplier payments with layered validation strategies that actually work.

In this whitepaper, you’ll learn how to:

- Replace manual bank validation with secure, automated validation

- Detect ownership changes, transactional red flags, and more

- Embed fraud prevention at the start of the supplier relationship

- Build a trusted framework without overhauling your system